4 min read

Do you see yourself as a proud homeowner? Sending your children to university? Planning the wedding of your dreams? No matter what your financial goals are, having a good credit score could open those doors for you.

What is a good credit score?

In today’s world, where credit has become necessary to accomplish so many of life’s milestones, your credit score acts as your financial report card. It’s a quick way for lenders and creditors to gain insight into your payment behaviour and assess risk. In other words, it shows lenders that you are trustworthy and responsible. You pay back what you borrow.

With that in mind, it’s crucial not to take on more debt than you can handle. Essentially, managing your debt responsibly signals to lenders that you are a lower-risk borrower, making them feel more confident lending you money. According to My Credit Status, a shocking 41% of credit-active South Africans are considered to be high-risk borrowers. This statistic emphasises the importance of creating and maintaining a healthy credit score now more than ever.

How a Good Credit Score Pays Off

Making your credit responsibility a priority and maintaining a high score has widespread benefits for all your financial needs.

1. Easier Loan and Credit Approvals

When you’ve worked hard to build a strong credit profile, lenders sit up and take notice. That good score sings your praises for them. You’re a customer with a history of responsible borrowing and on-time payments. For you, that likely means quick loan and credit approvals without hassles or headaches. Lenders will see your application and think, “Here’s someone who knows how to manage debt and isn’t a risk.”

While people with poor credit face rejections or sky-high rates, your good standing gives you the green light. You can land that bond to buy your dream home or finance a major purchase at a cost you can afford.

2. Better Loan Terms and Interest Rates

Having a solid credit score gives you the upper hand when negotiating loan terms with financial institutions. Lenders are more inclined to offer higher loan amounts and lower interest rates to individuals with a proven track record of responsible financial behaviour. Even a small difference in the interest rate can save you thousands over the life of a loan.

3. Eligibility for Premium Credit Cards

A good credit score will open up the most attractive credit card offers as well. Top-tier cards with lucrative sign-up bonuses, cash back, and travel perks usually require very good to excellent credit to qualify. Cards for average credit scores tend to have less impressive features and lower limits. But with a score above 700, you’ll receive invites for the premium cards with the most value. You’ll likely get instant approval for high credit limits.

4. Lower Insurance Premiums

Insurers care about your credit score too. Responsible borrowers tend to be responsible drivers and homeowners as well. That’s why those with higher scores often qualify for lower insurance rates. Auto and home insurance companies may provide discounts of 10% or more for customers with scores above a certain threshold. Maintaining good credit can put extra money back in your wallet every month through cheaper premiums.

5. Meeting Requirements for Rental Applications

Don’t forget that landlords often check credit reports and scores before approving rental applications. Especially in competitive markets, scoring well on credit checks can help secure the most desirable rental properties. Landlords view high scores as an indication that applicants will pay rent reliably and avoid late payments. With a mediocre score, you may have trouble getting approved or need a larger security deposit. But excellent credit means you can qualify for top rentals and negotiate optimal terms.

6. Qualifying for Internet Plans and Cell Phone Contracts

Even service providers such as internet companies and cell phone carriers regularly check credit scores when determining eligibility for new accounts. They want to minimise risk by only providing services to customers with demonstrated financial responsibility. With an excellent score, you’ll breeze through these credit checks. Providers will recognise you as a trustworthy customer and may readily offer you their new customer promotions and contracts.

How is Your Credit Score Calculated?

Your credit score boils down to how reliably you handle debt over time. Bureaus such as Experian and TransUnion, each have their own scoring model. Their formulas weigh different factors like your payment history, debt load, credit history length, new credit, and credit mix.

Payment history has the biggest impact. On-time payments show responsibility. Late or missed payments say you’re unreliable. Debt load also matters. Owing a lot, close to your limits looks risky even if you pay on time. Too many new accounts in a short period of time can also knock your score down. In general, the longer you’ve had credit, the better.

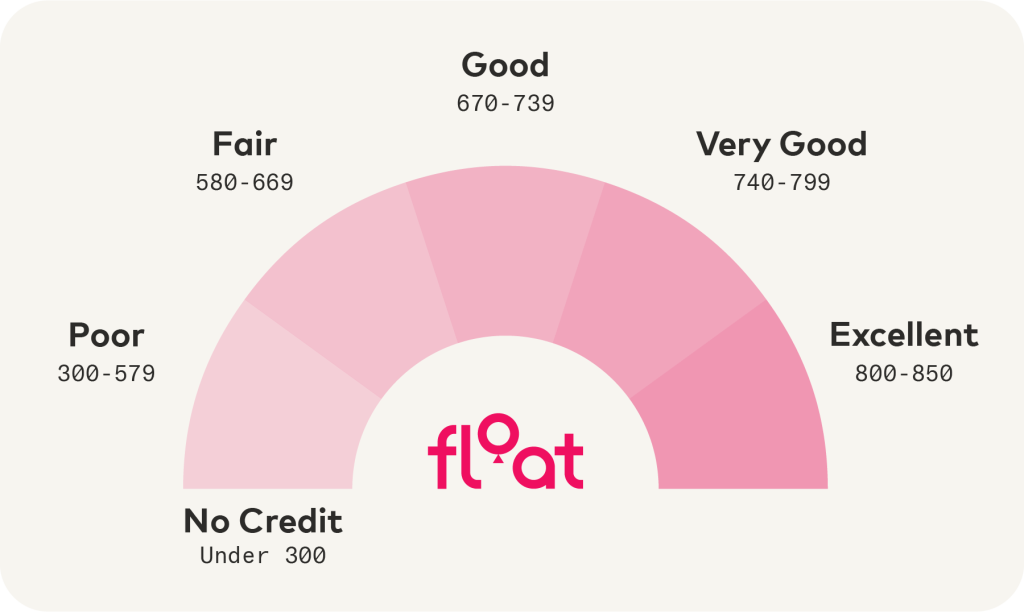

What Is The Credit Score Range?

No Credit – Under 300

This means there hasn’t been enough activity on your credit report yet to generate a score. It’s common if you’re just starting out. There’s no need to worry, just focus on building healthy credit habits.

Poor – 300-579

Scores in this range will make it difficult to get approved for financing or credit. Time to review your report and work on improving it.

Fair – 580-669

You’re in the ballpark but could benefit from some credit fine-tuning. Make payments on time and lower balances to bump them up.

Good – 670-739

With good credit, you’ll have access to most loans with decent rates. But you can still work towards an excellent score.

Very Good – 740-799

At this level, you’re getting the royal treatment when it comes to credit. But no reason not to aim for 850.

Excellent – 800-850

Lenders view you as virtually no risk. You’ll get prime borrowing rates and premium rewards.

Keep in mind, your scores vary across bureaus based on what’s in your individual reports. Checking all of them gives you a complete picture so you can tackle issues dragging down your numbers.

How to Maintain a Good Credit Score

Pay all your bills, big and small

Don’t play favourites or only pay the minimum on some while paying off others. Your score doesn’t see the difference between a clothing account bill and a car loan. Learn how to stick to your budget with our easy-to-read blog. Stay on top of it all.

Hold onto old credit cards if you can, even if you don’t use them often

Having a long credit history tells lenders you’re reliable over time. Just make sure to use them every so often so the card companies don’t close the accounts. For a more in-depth guide, take a look at our A South African Credit Card Comparison blog to help you find the right one to suit your needs.

Late payments hurt your score a lot

Set up automatic payments or calendar reminders so you never miss a due date. Even being a few days late can negatively impact your score.

Apply for new credit only when needed

New credit applications can temporarily lower your score by a few points. Space out new applications by at least 6-12 months when possible. New applications may indicate a higher risk to lenders even if you have a good payment history. Only apply for new credit when you genuinely need it.

Consider paying with Float

Rather than paying for big-ticket purchases upfront, consider a credit card instalment platform like Float. With Float, you can split your purchases over up to 24 interest-free, fee-free monthly instalments using your available credit limit. By breaking your purchase into manageable monthly instalments, Float makes settling your credit card in full and on time easier. No missed bills, no credit damage, and you continue earning those reward points you love!

Build Your Credit Score

Start building your credit score. If you’ve worked hard to build up your score, you’ve earned the right to reap some rewarding benefits. So take care of your score, and it will take care of you! Shop with Float today and save with zero fees, zero interest, no applications and no credit card checks.