FAQ

Any questions not answered by our Frequently Asked Questions? Contact us for more help.

Float is a buy now pay later platform that lets you split purchases over up to 24 interest-free, fee-free monthly instalments using the available limit on your existing Visa or Mastercard credit card, without any application or credit check.

Think of it like an interest-free ‘budget facility’ – you get to enjoy your purchases today, pay for them over time and you don’t take out any extra credit to do so, either.

The benefits of Float are simple:

Float splits your purchase into easy-to-manage, bite-size monthly instalments (as opposed to charging you the full amount up-front like a regular credit card transaction). In short – we buy you all the time in the world to settle your credit card balance. This is especially useful for those BIG value purchases.

- Float never charges you interest, fees, or late fees. Ever.

- Float helps you to use your existing credit on your credit card in the best way possible, so you’re not taking on any new credit.

- The cherry on top? You still get all your rewards points for using your credit card!

Float is available at hundreds of merchants including some of South Africa’s leading household brand names (online, in-store and for invoice sales). You can check out all of our merchants here.

Absolutely. ‘Float Anywhere’ gives you the same frictionless, flexible, and financially responsible experience, no matter where you’re purchasing from. Just ask the merchant for a Float QR code or payment link and you’ll be able to pay in interest-free instalments within seconds.

Yes – keeping your information secure is a top priority for us.

Float uses a PCI DSS Level 1 certified processor (the highest level of credit card data security standards) to handle your credit card data. This means we never store your credit card details and they always remain safely and securely encrypted. Float also makes use of 3D Secure to approve your initial payment authorisation, for an added level of security.

We also fully comply with POPIA in how we handle your personal information. For full details of our Privacy Policy click here.

You can use Float in 3 easy steps. There is no application and no credit check.

- Select Float as your payment option at checkout.

- Choose your number of instalments.

- Enter your credit card details and Float it!

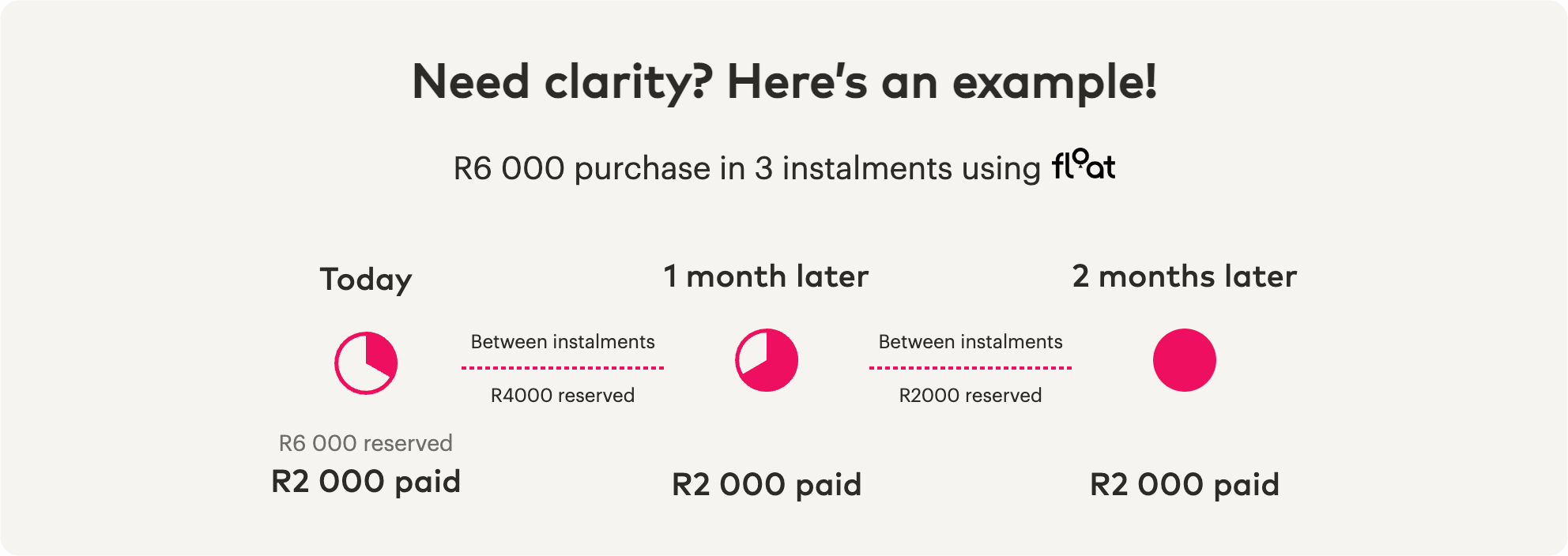

At the time of purchase, the full purchase amount will be reserved on your credit card, but only the first interest-free instalment will be charged. The remaining instalments are charged on the same day each month. As you pay each monthly instalment, the amount reserved will reduce to the remaining balance of the purchase until your purchase is fully paid.

To pay with Float, all you need is the following:

- A Visa or Mastercard credit card (no debit cards).

- The full purchase amount available on your credit card.

No – when you use Float to make a purchase, there is no application or registration whatsoever.

Because Float uses your existing credit card, we only require your credit card details and that you have the full amount of your purchase available on your credit card. Simple as that.

The number of instalments depends on what our merchant partners decide to offer their shoppers. This can range from 2 – 24 monthly instalments.

Float does not impose any limits on the size of purchases – we simply work within the available limit on your credit card. The bigger your available limit, the bigger the purchase you can make!

However, some merchants set their own maximum purchase value for Float transactions. Please contact them directly if you’d like to make a purchase larger than their maximum purchase value.

Float works with any Visa or Mastercard credit card. As with any other credit card purchase, you need to ensure that you have the full purchase amount available on your credit card.

Yes, we do!

Float works with any Visa or Mastercard credit card, even if it is a business credit card.

No. Float only accepts Visa and Mastercard credit cards with the full purchase amount available in your balance.

You must ensure that you have a valid Visa or Mastercard credit card with the full purchase amount available in your balance. Remember, debit cards, cheque cards, and hybrid cards are not accepted.

Yes!

There is zero interest and zero fees – even if you miss a payment. Please note that even though we buy you all the time in the world to settle your credit card balance, your credit card issuer may charge interest and other fees if you do not settle your credit card balance in time.

Yes!

Because you are using your existing credit card, you still get your rewards for making card payments.

No.

Because Float does not issue you with any new credit, we do not run credit checks and there is no additional impact on your credit score.

As Float uses your existing credit on your credit card, rather than issuing you new credit, there is no additional impact on your credit score.

In fact, when you pay with Float, your credit card utilisation (the amount of credit used on your card) is minimised to only the monthly instalment amount. Low utilisation looks great on your credit record – and so does settling your credit card balance each month! Float helps you to achieve both.

The first instalment is charged on the day of the purchase and on the same day each month until your purchase is fully paid.

You have not been charged the full amount. At the time of purchase, the full purchase amount will be reserved on your credit card, but only the first interest-free instalment will be charged. The remaining instalments are charged on the same day each month. As you pay each monthly instalment, the amount reserved will reduce to the remaining balance of the purchase until your purchase is fully paid.

- A reserve (also known as a pre-authorisation) is a hold against the credit you have available to spend on your credit card. It is not a charge and is completely interest-free.

- This ensures you don’t overspend on your card and helps you to meet your instalment repayments.

- As you pay each monthly instalment, the amount reserved will reduce to the remaining balance of the purchase until your purchase is fully paid.

- The reserve will be renewed in between each instalment. You will receive reminders from 7 days before the reserve is renewed.

- You may receive an SMS from your bank each time funds are reserved, and the reserve may appear as “pending” or “uncleared” in your account.

As Float works with your existing credit, and doesn’t issue you new credit, the reserve makes sure you have the full purchase amount available on your credit card. As you pay each monthly instalment, the amount reserved will reduce to the remaining balance of the purchase until your purchase is fully paid. This ensures you don’t overspend on your card and helps you to meet your instalment repayments.

Remember:

- The reserved amount is not a charge and is completely interest-free.

- The reserve will be renewed in between each instalment, not on the instalment date.

- You will receive reminders from 7 days before the reserve renewal date.

- You may receive an SMS from your bank each time funds are reserved, and the reserve may appear as “pending” or “uncleared” in your account.

The reserve will be renewed in between each instalment, not on the instalment date. You will receive reminders from 7 days before the reserve renewal date.

The reserve will be on hold against your credit card until your purchase is fully paid. As you pay each monthly instalment, the amount reserved will reduce to the remaining balance of the purchase until your purchase is fully paid.

Please note that your bank may automatically release the reserved funds back into your available balance before it is renewed. However, you are still required to keep the remaining balance of your purchase available on your card throughout your instalment plan.

If the current reserve still appears as “pending” or “uncleared” in your account, don’t worry. It will be automatically released by your bank, but can take up to a few days or more to reflect in your account.

If the previous reserve still appears as “pending” or “uncleared” in your account, don’t worry. It will be automatically released by your bank, but can take up to a few days or more to reflect in your account.

Instalment amounts are deducted from the reserved amount, not over and above it. However, some banks reflect the instalment and the reserve as separate amounts.

Instalments are your monthly repayments for your purchase that are charged to your credit card.

A reserve (also known as a pre-authorisation) is a hold against the credit you have available to spend on your credit card. It is not a charge and is completely interest-free. This ensures you don’t overspend on your card and helps you to meet your instalment repayments.

The reserve expires after a certain amount of time (the amount of time depends on the type of credit card you are using) and it needs to be renewed to ensure we have a continuous guarantee of future payments. Because the time it takes for a reserve to expire is generally up to a few weeks (often less than a month), the reserve needs to be renewed more frequently than the instalments are charged.

You will receive reminders from 7 days before the reserve renewal date.

The reserve expires after a certain amount of time (the amount of time depends on the type of credit card you are using) and it needs to be renewed to ensure we have a continuous guarantee of future payments. Because the time it takes for a reserve to expire is generally up to a few weeks (often less than a month), the reserve needs to be renewed more frequently than the instalments are charged.

As the reserve is renewed more frequently than your monthly instalments, this means that the reserve may sometimes be renewed twice in the same month.

You will receive reminders from 7 days before the reserve renewal date.

We will always email you reminders about upcoming instalments or reserves before they are due, so please make sure you have enough balance left on your credit card to allow for these. It’s important to note that the reserve will be renewed in between each instalment, not on the instalment date.

If a payment or reserve is unsuccessful, you will be given 7 days to make sure you have a valid credit card with enough balance. During this time, we will reattempt to collect the instalment or renew the reserve.

After 7 days, if we are unable to collect the instalment or renew the reserve, we will charge the previously held reserve on your card for the remaining balance of your purchase and your instalment plan will be complete.

Float emails you a monthly statement for your remaining instalments and gives you access to the Float Shopper Portal where you can view your instalment plans whenever you want.

You can also check your monthly credit card statements, or online banking, to see the monthly charges deducted by Float for your purchases. Remember, the outstanding balance of your purchase is reserved throughout the instalment plan, until it is fully paid, so you may also see a “pending” or “uncleared” transaction for that amount. This is not a charge and is completely interest-free.

No.

Your instalment plan schedule is set up at the time of purchase, and the remaining instalments are charged on the same day each month. This date cannot be changed.

Your credit card statement will show the monthly instalment charge for that month. Because the instalment amount is deducted from the reserve amount, your bank may reflect your instalment charge on the reserve renewal date.

Some banks reflect the reserve amount as a separate amount in your credit card statement under “Transactions Not Yet Processed”.

Absolutely! Float encourages good financial behaviour, and we believe settling early is exactly that. If you would like to settle early, please contact us at support@float.co.za.

You will be emailed your login details for the Float Shopper Portal immediately after your purchase, where you can view your Float account. This link will expire after 24 hours, so if you did not access the Float Shopper Portal in time, please retry by using the same email address linked to your instalment plan and click on “Forgot Password?”.

Please contact your bank immediately to cancel or freeze your credit card.

If your credit card needs to be replaced, you will also need to update your credit card details with Float, which you can do via the Float Shopper Portal. Please be sure to use a valid Visa or Mastercard credit card, with the full remaining balance of the purchase available on your card. If successfully updated, the remaining balance will be reserved on your new credit card.

You can still pay in instalments using Float, even if your credit card is going to expire during the instalment plan. From one month before your credit card expires, we will email you regular reminders to update your credit card. You can update your credit card details via the Float Shopper Portal. If you do not update your credit card details during your instalment plan, the remaining balance of your purchase will be captured from your credit card.

Yes.

You can update your credit card details via the Float Shopper Portal at any time. Please be sure to use a valid Visa or Mastercard credit card, with the full remaining balance of the purchase available on your card. If successfully updated, the remaining balance will be reserved on your new credit card.

Float provides a platform to the merchant that allows them to offer interest-free instalment plans to their shoppers.

The merchant is solely responsible for your order in line with their terms and conditions. As such, any issues with your order are handled by the merchant you purchased from, so please contact them directly. Your instalment plan will continue until the merchant instructs us otherwise.

However, if there are any issues with your instalment plan, we are here to help you, always!

Returns or refunds must happen directly with the merchant where you made your purchase. They will process your request within their normal refund/return policy. Once the merchant has approved the refund, they will notify us and we will adjust your instalment plan or refund money back to you.

Please contact the merchant you made your purchase from as we are not authorised to cancel your plan. They will process your request within their normal refund/return policy.

Unfortunately, not.

Refund queries are approved and handled by the merchant you bought from and we have no authority to approve a refund on their behalf.

If there’s a problem with an item or service you bought and the merchant is refusing to refund you, please let us know and we will do our best to assist you.

Your instalment plan will continue until the merchant instructs us otherwise.

Float is a buy now, pay later platform that lets you split purchases over up to 24 interest-free, fee-free monthly instalments using the available limit on your existing Visa or Mastercard credit card, without any application or credit check.

Think of it like an interest-free ‘budget facility’ – you get to enjoy your purchases today, pay for them over time and you don’t take out any extra credit to do so, either.

The benefits of offering Float as a payment option are many, but here are just a few:

- Increase average order values by 134% on average;

- Drastically improve conversions; and

- Grow incremental sales.

As Float is instantly accessible to around 5 million pre-approved credit card holders in South Africa alone, you’re opening your business to a pool of potential shoppers with more purchasing power than ever before.

Float is the most flexible, frictionless, and financially responsible buy now, pay later platform in South Africa. Here are just a few reasons why:

- Frictionless checkouts for your shoppers, with no applications or credit checks.

- No limits on order sizes (Float’s average order is around 10x larger than other buy now pay later platforms), meaning you can sell those big-ticket items with ease.

- Longer and more flexible repayment periods than any other buy now, pay later platforms.

- Customisable for your business – the number of instalments offered, minimum order values and even the settlement terms for your sales made through Float.

- Importantly, Float takes on the risk of collecting repayments and guarantees settlement to you.

Float is a payment method for your customers (we call them ‘shoppers’). It can be offered via ecommerce checkout, in-store, on an invoice, or even over email/text message.

When a shopper makes a purchase using Float, they get to enjoy your goods/services today and pay in interest-free monthly instalments. We take on the risk of collecting repayments from shoppers and settle you either in full or in instalments (you can choose how you’d like to be settled).

Absolutely! You get to customise your Float offering to suit your business’s needs in 3 ways:

- The number of instalments offered to your shoppers;

- Minimum order values; and

- When and how you get paid for your sales processed through Float (either in full or in instalments).

We’re delighted that you’re interested in partnering with Float to grow your business! Please complete a merchant enquiry form. Alternatively, please feel free to contact us at grow@float.co.za or (+27) 10 012 6415 and we’ll be glad to assist.

We are proud to be a truly omni-channel solution. Float can be offered in many ways to suit your business’s needs, such as:

- On your ecommerce website, via one of our easy-to-use plug-ins or our Float API;

- In-store via a QR code (this can be integrated into your POS or standalone); or

- Using a payment link (sent via email/text message or on an invoice).

Whether in-store via a QR code, or using a payment link (sent via email/text message or on an invoice), Float Anywhere gives your shoppers the same frictionless, flexible, and financially responsible experience, no matter where you’re making a sale.

Yes, we do!

Float works with any Visa or Mastercard credit card, even if it is a business credit card.

Shoppers can use Float in 3 easy steps. There is no application and no credit check.

- Select Float as their payment option at checkout.

- Choose their number of instalments.

- Enter their credit card details and Float it!

Float does not impose any limits on the size of purchases – we simply work within the available limit on a shopper’s credit card. However, you can customise minimum order amounts for purchases to suit your business’s needs.

Float can facilitate up to 24 monthly instalments. However, you can customise the number of instalments offered to your shoppers to suit your business’s needs.

Getting set-up with Float is super easy! We have easy to use plug-ins and APIs for e-commerce stores and our Float Anywhere offering will be ready to use as soon as your account is activated. We’ll also support you throughout the on-boarding process to ensure we get you live as seamlessly as possible.

Float currently has integrations with WooCommerce, Magento, Shopify and ShopStar, with many more on the way. Our Float API is also available for custom integrations, giving you the power to define your own customer experience.

Don’t worry! Float takes on the risk of collecting repayments, similar to offering regular credit card payments.

You choose how often you want to get settled for sales processed through Float. You can either receive the full value of the purchase upfront, or you can receive settlements over time, as shoppers pay off their monthly instalments. In both cases, your shoppers get their purchases upfront.

Float charges a fee for each successful transaction processed through our platform. As Float is completely customisable for each of our merchants, the fee depends on a number of factors. Please complete a merchant enquiry form or contact us at grow@float.co.za and we’ll be happy to discuss the fee structure in further detail.

Float will always work in line with your refunds and returns policy. Shoppers should always notify you directly for any returns, refunds, or exchanges, just like any other transaction. If you decide to process a refund or return, you can let us know with a simple electronic request via the merchant portal and our system will automatically calculate and process any amounts due back to the shopper.

Choose Float at checkout

All you have to do is choose Float at checkout, and we do the rest